A Beginner’s Guide to Bitcoin

Preface

As Bitcoin becomes more integrated into our lives and the global financial system, understanding how it works and how to secure it will become increasingly valuable.

With this guide I hope to enable your first steps in understanding this new form of money and empower you with the best and safest tools to manage your growing wealth.

What this guide is not:

An intro in the world of crypto. You won’t find any platforms or wallets that support other cryptocurrencies. The goal is to teach you why Bitcoin is different and why there is no second best.Beginner Recommendation

If you prefer learning with easy to follow videos, check out the learning path for absolute beginners. Or check out the full Beginners Resources section

Part 1: Why Bitcoin?

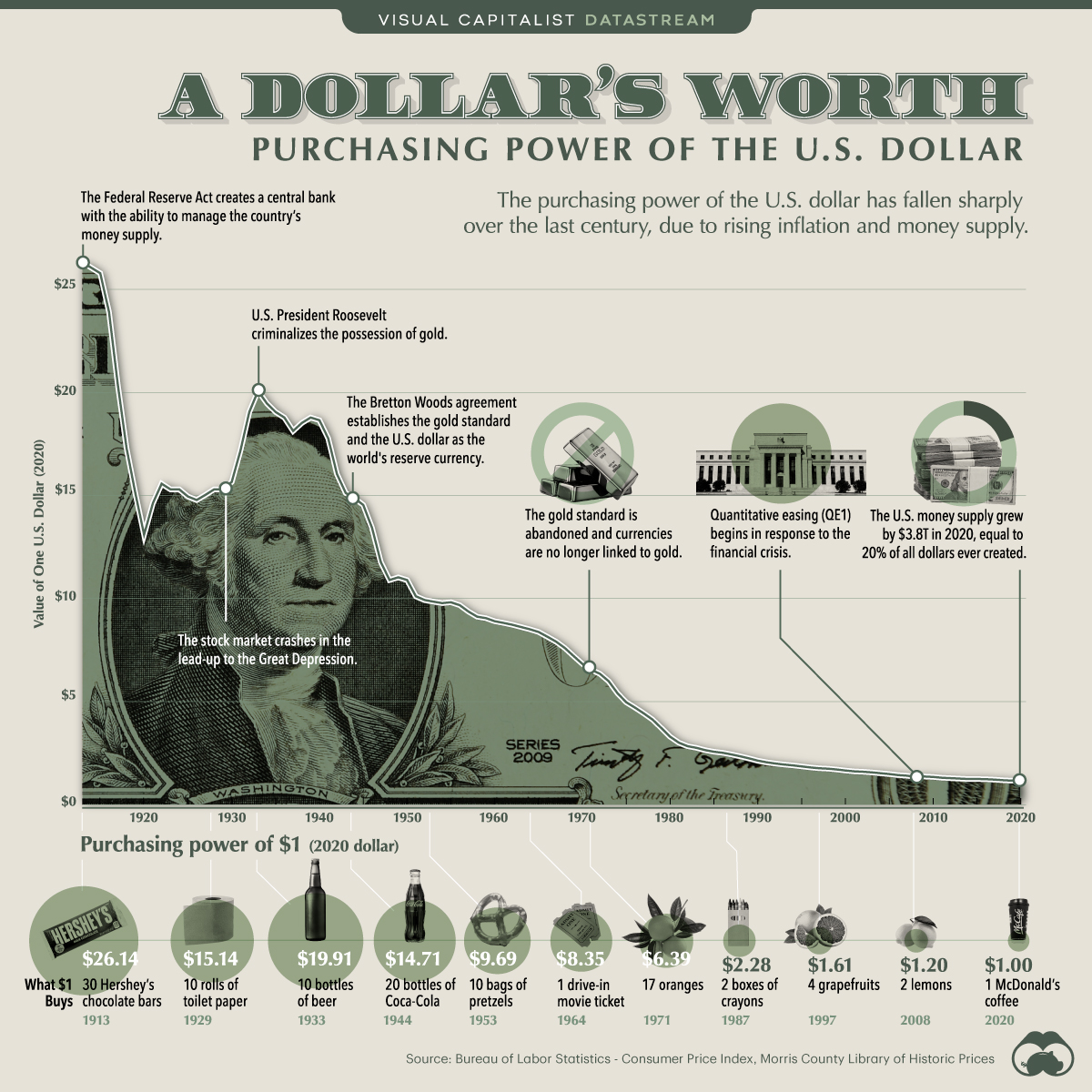

The Problem with Fiat Money

Ever notice how your money buys less and less each year? You work hard, you save, but prices keep going up. 1 dollar today might hold the same value as 1.05 dollar in a year, meaning that future dollar is worth only 0.95 in today’s dollars. The number in your bank account stays the same, but you now need more of it to buy the same thing. That’s inflation, the silent tax that quietly shrinks your savings. But what causes it? Most people see inflation as simply rising consumer prices. But many don’t fully grasp its true origin. At its root, inflation is mainly created by the growth of the money supply (caused by “printing money” or issuing loans). On top of that, these decisions are all made by only a few central parties, and you just need to trust them. This means the rules can change unexpectedly, and planning for the future becomes harder.

This traditional money system controlled by governments and central bank(s), often called “fiat money,” clearly has its drawbacks. Payments seem to work great, but savings get eroded over time without you realising it. There lies the problem. In most Western countries people don’t feel like they need something new – and many think rising prices is just a natural part of the system.

You may wonder how we ended up in a situation where we need to work harder and longer for what a small group of people can print? Well, it hasn’t always been this way. We used to have better money when the world was on a gold standard. Gold was once a trusted money, valued for its scarcity and durability. It emerged naturally in many different parts of the world. But it wasn’t immune to corruption either. In ancient times, rulers slowly abused their power over money, mixing the coins with cheaper metals to make more of them. Over time, when trading became more and more globalized, people moved their gold into central vaults and used paper certificates as a promise of the real thing. Those in power, however, could not resist creating more certificates than they had gold. This practice of debasement culminated in 1971, when the last connection between the dollar and gold was finally broken, leaving the U.S. with a money based on nothing but trust in its issuer. As the US Dollar was the world reserve currency, the whole world was now taking part in a new experiment of unbacked government money.

Why We Need Something New

The problems with fiat money can all be summarized as a problem of trust, resulting in unpredictable and arbitrary amounts of inflation. We need a new kind of money that doesn’t demand this trust. For centuries, gold worked as money because it was scarce, making it hard to inflate. On top of that, it was a “bearer asset“: its value was in the object itself; you held it, you owned it. These properties were reassuring and gave confidence which made them a powerful foundation for money throughout the ages.

Fiat money today is completely separated from anything with good monetary properties. Its value is based entirely on the trust we place in the governments and banks that issue it. Most of the money we use isn’t even physical; it’s just credit, a number in a bank’s database, or a line on a balance sheet. This system, built on layers of trust, makes us dependent on central parties to function, and we have to trust them not to abuse their power. If the level of trust we now put in these centralized systems is the problem, how could it be solved? What if we could remove that trust and have a more fair and transparent system? Like physical gold, but for a globalized and digital age.

This created a major challenge: how do you send value electronically from person to person without a central party to verify everything, to make sure the value isn’t double spent? For decades, computer scientists and cryptographers tried to create a digital cash that was scarce and couldn’t be easily copied. Every attempt failed because it always required a central server or a trusted company. Bitcoin was the first to finally solve this, creating a form of digital money that removes the need for a trusted middleman entirely, that is built on clear, fixed rules that apply to everyone.

What Bitcoin Can Do For You

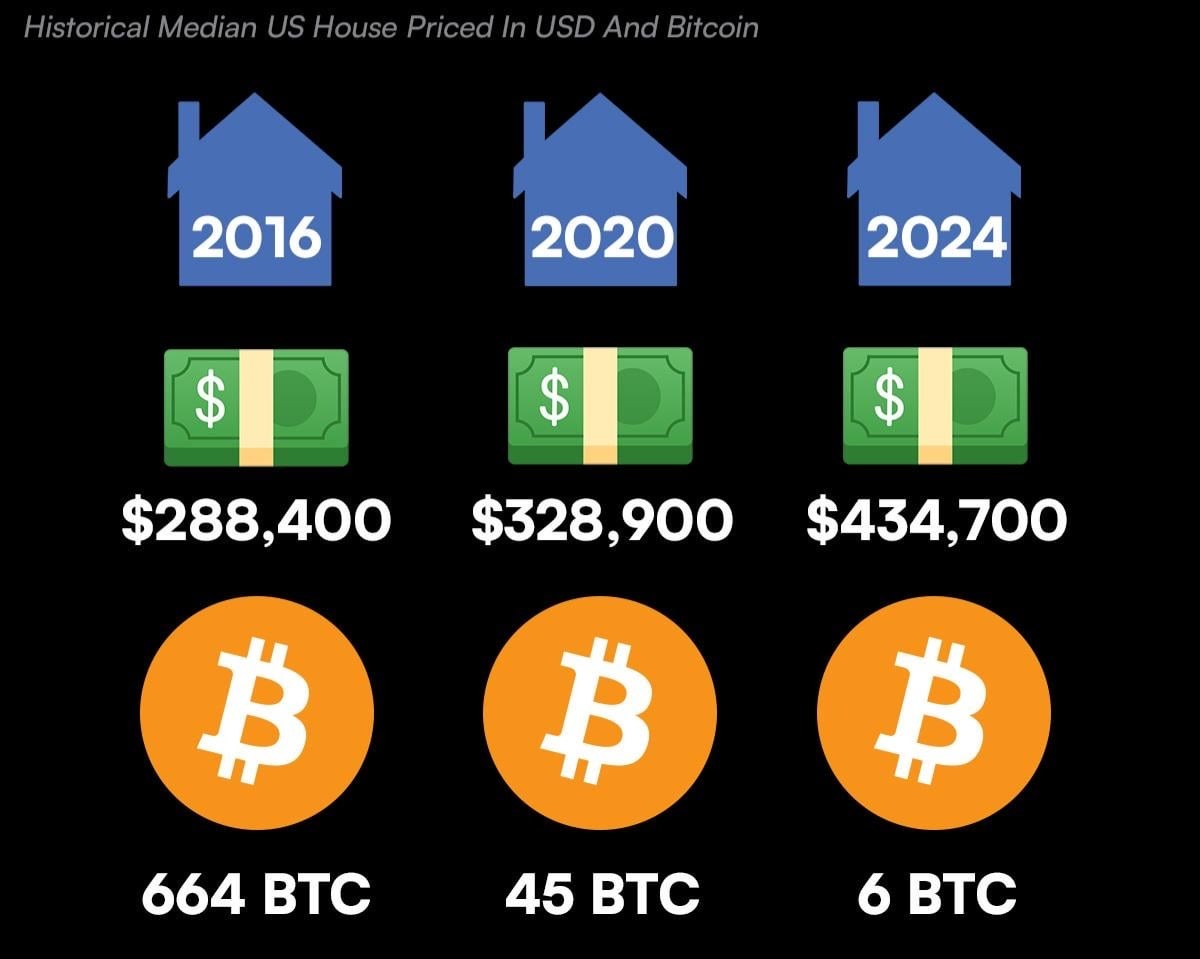

Bitcoin is not only a defense against inflation but has also become the best-performing asset in history. Over the last decade, Bitcoin has seen yearly returns far greater than traditional assets. For example, its 10-year average annual growth rate has been over 80%, compared to roughly 12% for the S&P 500 and a little over 10% for gold. This historical data shows that even investing a small percentage of your portfolio into Bitcoin could have dramatically boosted its long-term performance. If you can survive the short-term volatility, meaning holding for at least 4 years, its scarcity and role as a global, permissionless asset will likely mean a continued strong performance in the future.

The other major benefit of Bitcoin is that it gives you complete control. In the current system, your money is held in a bank account, and that bank can sometimes make risky decisions or even fail. By holding Bitcoin, you can take true possession of your money. This removes the risk of a third party, like a bank or government, having control over your funds. Your Bitcoin is truly your own and not just an entry in a bank’s ledger. It’s like having gold in a safe, but with the freedom and ease of a digital asset.

Key Takeaways

- Fiat money is based on trust in central parties and credit, not on inherent scarcity or a physical asset.

- Inflation, or the growth of the money supply, is a silent tax that erodes the purchasing power of your savings over time.

- Bitcoin was created to solve the “double-spend” problem for digital money, creating a system that doesn’t require a trusted middleman.

- Bitcoin’s fixed supply and decentralized network offer a transparent alternative to the problems of fiat money.

- Compared to other tradition assets, Bitcoin has performed extremely well over the past decade. This growth is likely to continue.

- Bitcoin allows you to securely hold your money in your own possession, protecting you from the possibility of bank failures

Part 2: The Basics

What Bitcoin Is

Bitcoin is an electronic payment system for pure digital money, developed and released anonymously by Satoshi Nakamoto in January 2009, as a response to the 2007-2008 financial crisis. There’s no physical coin, no central bank, no company or no government behind it. Instead, it’s secured by advanced math and the agreement of thousands of computers around the world. Because of this decentralization, no single person or group can turn it off, change its rules, or print more of it.

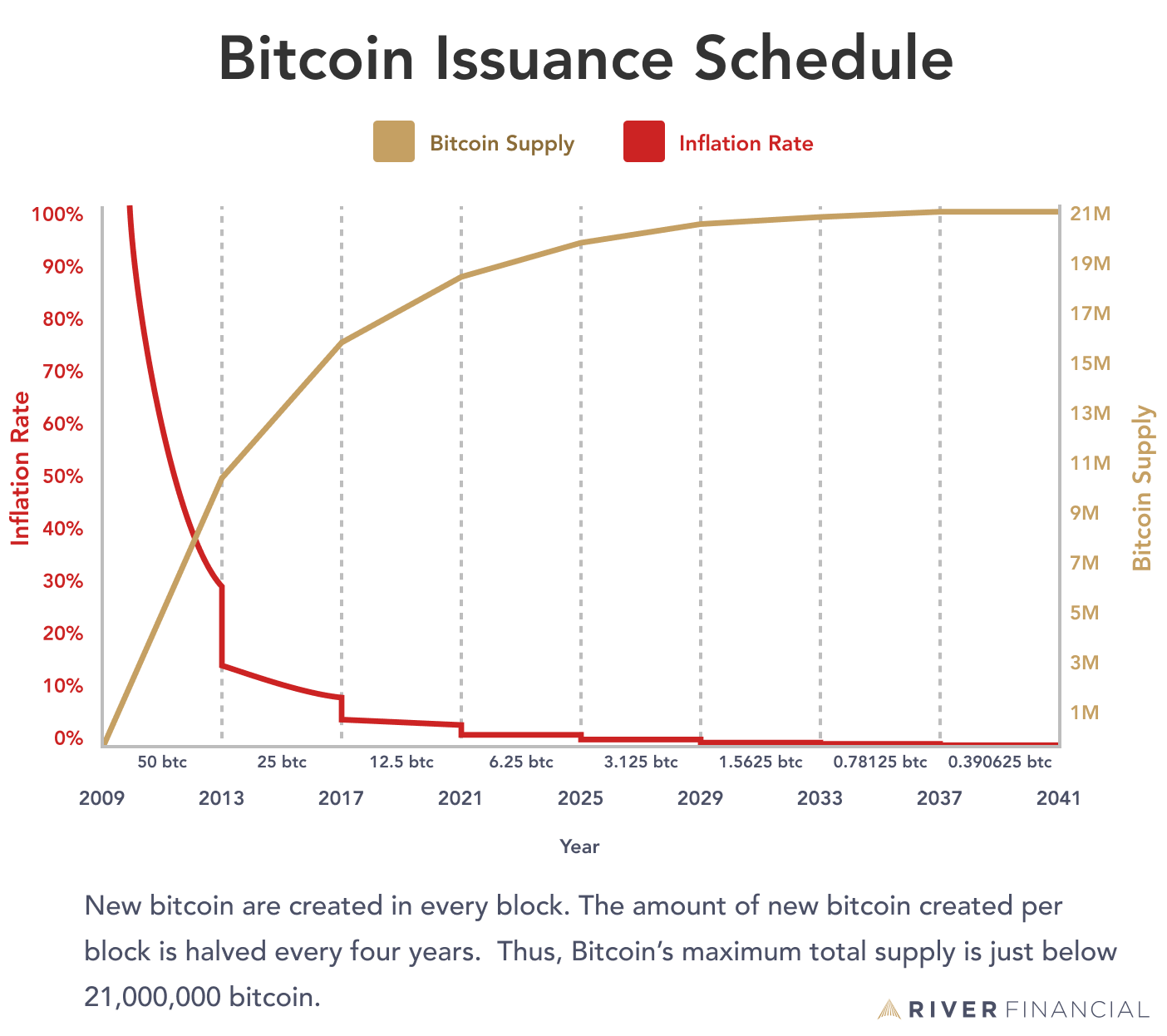

This means Bitcoin has a fixed supply – only 21 million will ever exist, making it absolutely scarce. It’s decentralized, meaning no one controls it. Anyone can create an account and send any amount of money to anyone in the world. It’s censorship-resistant, so no authority can stop you from sending or receiving it. Unlike your bank, you do not need to ask anyone for permission. It’s simply digital cash that works without needing a middleman.

Bitcoin the network, with capital B, is very difficult to change as a protocol. By running on tens of thousands of computers worldwide, it forms a global, robust network that enforces the protocol rules, the most important being the 21 million supply cap. If you would make your own version of Bitcoin (it is open source software) with a new set of rules, you would need to convince all the people running the code (nodes) to update their nodes and play the new game (imagine trying this with the English language or the game of chess).

The asset used on the network, bitcoin with lowercase b or often shortened as the unit ‘BTC’, represents the state of ownership. It’s any amount of bitcoin, linked to a unique address. Once recorded, it is practically impossible to change a transaction, giving it a high degree of finality. As Satoshi solved the double-spend problem, it is now possible for digital objects to behave like physical objects in cyberspace, which had never been achieved before without a trusted middleman.

How Bitcoin Works

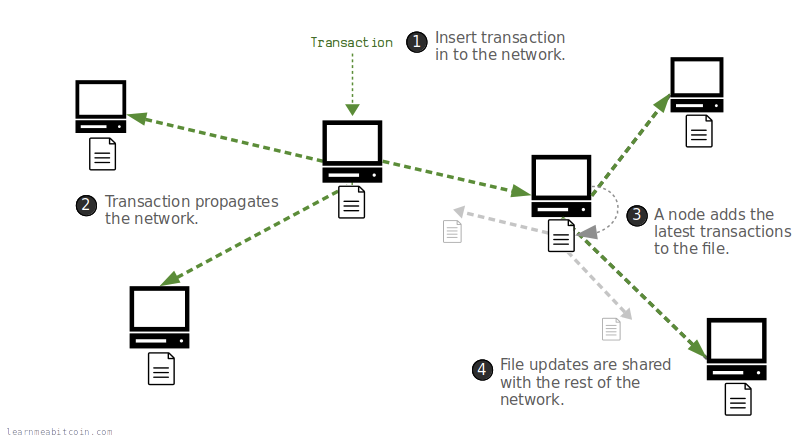

Think of bitcoin as entries on a giant, public spreadsheet, or ledger. This ledger is called the blockchain. Every Bitcoin transaction – who sent what to whom – gets recorded here. Once a transaction is added, it can’t be changed or deleted. Everyone can see it, but no one can alter it. The ledger is basically a distributed file, meaning it does not live in one central place but is copied tens of thousands of times all over the world. Anyone can be part of the network and become a node by running a piece of software with a copy of the ledger.

So, if there is no central authority, who maintains the ledger? People called “miners” do. They use powerful computers to solve complex number puzzles. It’s like a global competition to be the first to guess a valid number. The first miner to find the right number gets to add the next “page” (or block) of transactions to the blockchain. This process makes sure that anyone who does some “work” can earn the privilege to write to the ledger. But why would anyone want to do this and spend processing power? The winning miner receives a reward in the form of newly created bitcoin that did not previously exist. This reward creates two benefits, first, it draws in miners who want to make a business out of this operation, protecting and maintaining the network, and secondly, it’s a way of gradually distributing the coins over time, to anyone who wants to do the work, creating a fair system.

The last piece of the puzzle was making sure that the new coins could be created gradually in a predictable way. Because if more people would start mining and “guessing numbers”, the faster the blocks would be added to the ledger, leading to sudden increases in the money supply (which was one of the things to be prevented). By automatically adjusting the difficulty of finding a valid number, an average block time of 10 minutes could be targeted. No matter how many miners joining this world-wide competition, roughly every 10 minutes a new block of transactions is added to the chain, releasing a fixed amount of new bitcoin into circulation (currently 3.125 BTC). Every four years, a halving of this reward takes place. Before the previous halving, the winning miner received 6.25 BTC and after the next halving he will receive 1.5625 BTC. This creates a gradual and fixed release schedule until all 21 million coins are mined. Think of it as Bitcoin’s inflation rate trending to zero. The very last piece of bitcoin is estimated to be mined in the year 2140.

How bitcoin is owned

When you “own” Bitcoin, you’re not actually holding a digital coin. What you have in your possession is a set of cryptographic keys – a public key and a private key– that prove you have control over a certain amount of bitcoin on the public ledger. These keys have a mathematical connection to one another; a private key is a secret, randomly generated number, and your public key is derived from it. Bitcoin’s system is built on this cryptography, making sure that only the person with the correct private key can authorize a transaction and spend their bitcoin. The relationship between your keys is simple: your private key is like a highly secure password that gives you full control of your funds, while your public key is used to create your bitcoin addresses, which is like a public bank account number that you share with people. You can share your addresses freely with anyone who wants to send you bitcoin. However, your private key must be kept secret at all times. Losing it means losing your bitcoin, and if someone else gets a copy or even a glimpse, they can steal your funds. This is why the saying “not your keys, not your bitcoin” is a fundamental principle in the space.

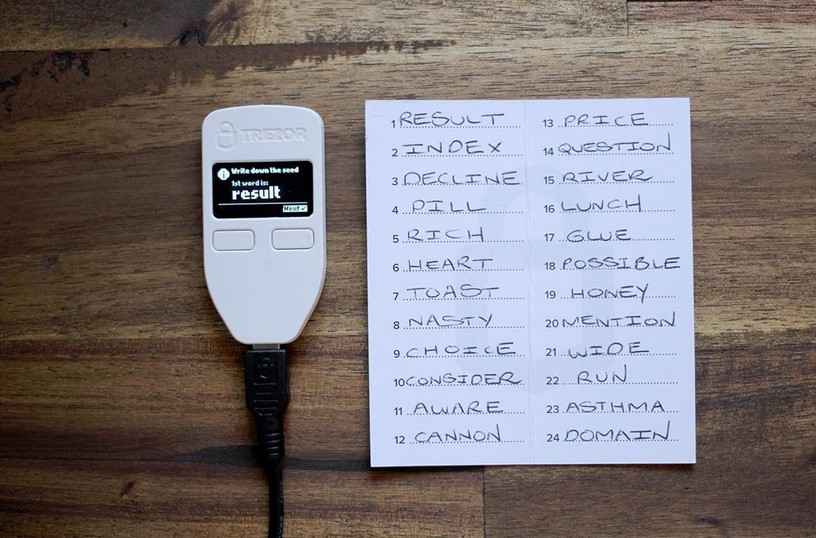

A wallet is a software application or a hardware device that is designed to generate, manage, and store your cryptographic keys securely. It allows you to create new addresses, view your balance, and most importantly, sign transactions with your private key to send bitcoin to others. The wallet does the hard work of managing the complex cryptography for you and provides a user-friendly interface to interact with the Bitcoin network. Beyond just your private key, your wallet will also provide you with a seed phrase, sometimes called a recovery phrase. This is typically a list of 12 or 24 words (from a list of 2048 words) in a specific order. See it as a human readable version of your raw private key. This seed phrase is the ultimate backup for your private keys and all the bitcoin addresses they control. If your wallet gets lost, stolen, or damaged, you can use this seed phrase to restore your wallet and regain access to all your funds on any compatible wallet software. Just like a private key, your seed phrase must be kept absolutely secret and secure, as anyone with access to it can take control of your bitcoin.

Wallets come in different forms, broadly categorized as hot wallets and cold wallets. Hot wallets are software wallets that are connected to the internet, such as mobile apps, browser extensions or programs on your computer. They offer convenience for small, everyday transactions and often provide access to layers like the Lightning Network for fast and cheap payments. However, because they are online, they can be more vulnerable to security risks.

For maximum security, especially when storing larger amounts, cold wallets or hardware wallets are the recommended choice. These are dedicated physical devices that keep your private keys completely offline and isolated from your computer or phone. This offline storage makes it virtually impossible for hackers to steal your keys. You only connect the device when you need to sign a transaction. For beginners and intermediates, a “singlesig” wallet is usually the best choice, it means one key controls your Bitcoin. For larger amounts, go for a “multisig” wallet, where multiple keys are needed to sign a transaction (e.g. 2-of-3 or 3-of-5).

For small, everyday payments, sometimes the main Bitcoin network can be slow or costly. The Lightning Network solved this by moving transactions to a second layer where fees are almost zero and speeds are lightning fast. Think of it as a faster, cheaper layer built on top of Bitcoin, perfect for quick coffee purchases or sending small amounts without waiting long.

Bitcoin vs. “Crypto”

When you hear “crypto,” you might think of all the many digital currencies and wonder what sets them apart. Bitcoin is unique because it is the only system that answers to the core problems of traditional fiat money. Unlike most crypto projects, Bitcoin has one clear goal: to be sound, decentralized and permissionless money. This clear focus and strong technical foundation give Bitcoin a stability and certainty that sets it apart from the broader crypto market, which is often driven by solutions in search of a problem (at best), or hype and degeneracy like NFTs, and memecoins (at worst).

The events that led to Bitcoin’s take-off are unique and extremely hard to replicate. It was a one-time discovery of absolute digital scarcity. Its founder, Satoshi Nakamoto, disappeared shortly after its creation, ensuring it had no central leader, company, or CEO. Like gold, Bitcoin has no founder or organization to be targeted and no single point of control, which is the cornerstone of its decentralization.

This is what makes Bitcoin ethical money. Other crypto projects cannot achieve this level of decentralization because they are typically launched with large allocations to founders, insiders, venture capitalists and development teams. The project is often centrally coordinated, with a clear coorporation or public figure in charge. These early investors get rich by extracting wealth from the public, who are lured in by promises of getting rich quick but are often too late to the game. That’s why crypto is less of a financial innovation and more of a speculative casino.

Do not be fooled by people promoting a coin because it has certain improvements over Bitcoin. They focus on speed, or being “environmentally friendly”. The truth is none of them can compete with Bitcoin’s security and decentralization, which forms the bedrock on which to build other layers for improvement. Money scales in layers, with the base layer settling large transactions with high assurance and security, while higher layers can be used for small daily purchases, with the trade-off of less security or even asking for permission.

The last and most important reason why there is no real competition to Bitcoin is because of the way in which agreement (consensus) is reached on the network. This mechanism is called Proof-of-Work and refers to the real world energy that needs to be spent in order to maintain property rights in the the virtual world. Just by looking at a valid Bitcoin block we know for sure that work was done in the real world. It is the only way to know that something is real in cyberspace, and not just a figment of the imagination, created by software administrators that wield enourmous abstract power.

Key Takeaways

- Bitcoin is a decentralized, censorship-resistant digital currency with a fixed supply of 21 million units.

- The blockchain is a public, unchangeable ledger where all transactions are recorded.

- You don’t own a “coin,” you own a private key that gives you the right to move that coin to a different address on the ledger. The phrase “not your keys, not your bitcoin” is essential.

- Wallets are tools that store your keys, and a seed phrase is a backup for your keys.

- Unlike most “crypto” projects, Bitcoin is truly decentralized with a clear, focused goal of being sound money.

- Proof-of-Work is the only mechanism to know that real-world effort (work) has been done to create something digital.

Part 3: Getting Started

How to buy bitcoin

Buying Bitcoin should be simple and secure. Start by using a reputable exchange, preferably a Bitcoin-only exchange like Strike. This is a “hard-KYC” platform, meaning you need to provide your full identity and they hold your Bitcoin until you send it to your own wallet (taking custody).

Options for “soft-KYC” are Relai, Pocket or GetBittr. These platforms let you connect your regular bank account to your Bitcoin buying, so you can buy Bitcoin by simply wiring payments and receiving directly into your own wallet.

The best time to buy Bitcoin is not to try and guess the “perfect” time. That’s almost impossible. Instead, use Dollar-Cost Averaging (DCA). This means buying a fixed, small amount of Bitcoin regularly – say, every week or every month. It’s like consistently putting a small amount into a savings account. This strategy smooths out the ups and downs of the market and helps you build your Bitcoin holdings steadily over time, without the stress of trying to time the market.

Lastly, as you might have guessed by now, you do not need to buy a whole Bitcoin. Just like you have 100 cents to a dollar, one bitcoin can be subdivided in 100 million satoshis or sats. Your DCA strategy could be a weekly purchase of 0.0005 BTC or 50,000 sats (roughly 50 USD at the time of writing).

Taking Custody

Once you’ve bought Bitcoin on an exchange, it’s crucial to take control of it. This means moving your bitcoin off the exchange and into a wallet where you control the keys. This is what we call moving Bitcoin to self-custody, and it’s perhaps the most important step for any Bitcoin holder. As long as your Bitcoin is on an exchange, all you have is numbers on a screen, and you don’t own anything. If the exchange gets hacked, goes out of business, or freezes your account, your Bitcoin could be lost or inaccessible. Self-custody means you hold the keys, and therefore, you hold the power and responsibility over your money. As a beginner you might not want to purchase a hardware wallet (or “cold” wallet) on day one, but start with a trusted and open-source software wallet (or “hot” wallet).

Here are the best picks for software wallets:

- BlueWallet (mobile): top for beginner friendliness

- Muun (mobile): beginner-proof interface and supports Lightning

- Nunchuck: More advanced but excellent UX for simple hot wallets as well as connecting to a hardware wallet via QR

Beginner Recommendation

Go for Blue Wallet to keep it minimal yet powerful. Bull Bitcoinhas a great detailed tutorial on Blue Wallet.

These wallets offer way more than just holding bitcoin on-chain, but are still friendly enough for beginners.

For the more tech-savvy and adventurous user, I would recommend Sparrow wallet (desktop). This is becoming an industry standard due to its robust feature set and excellent hardware wallet support. Many find themselves moving to a more advanced wallet like Sparrow as their understanding of Bitcoin grows. Learning to use it from the start can be a great way to future-proof your setup.

Never store large amounts on a hot wallet long term.

Once you have saved up some sats and got the hang of securing your seed phrase and sending and receiving bitcoin, it’s time to purchase your first hardware wallet and take your security to the next level. For beginners, a simple hardware wallet from a trusted vendor is often enough. Many hardware wallets have excellent setup-instructions and will guide you to a confident level of understanding.

Here are the best picks for hardware wallets at reasonable prices:

- Trezor Model One with Bitcoin-only firmware (49 EUR)

- Trezor Safe 3 Bitcoin-only edition (79 EUR)

- Blockstream Jade (69 EUR)

- SeedSigner (preassembled) (96 EUR) – learn more about SeedSigner in this blog post

Beginner Recommendation

Go for top hardware quality and modern features and get the Trezor Safe 3 Bitcoin-only edition.

When setting up your hardware wallet, the software will guide you in saving and verifying your seed phrase. You will have to write this down and store it somewhere secret and safe. Know that later on, you might want to get a metal backup solution to protect you from fire and water.

Some best practices when setting up and using hardware wallets:

- Back up your seed phrase: Pen and paper, no screenshots, no cloud storage.

- Send small test transactions: Learn how UTXOs work.

- Test recovery: After receiving a test transaction, wipe your wallet and start over by recovery from seed. This will give you a huge confidence boost.

- Label your coins (Sparrow supports this): Learn coin control.

- Don’t reuse addresses: Wallets handle this automatically, but know why it’s important.

Living with Bitcoin

Bitcoin is money, meaning it isn’t just for saving; it can also be used for spending. But many people who believe in its ongoing adoption are hesitant to spend their bitcoin. Why would you spend something that is going to be worth more in the future? As Bitcoin is still in its early growth phase, you can protect yourself from future regret by adopting a “spend and replace” mindset. Use Bitcoin for purchases, but immediately buy back the same amount with fiat (your local currency) to keep your long-term Bitcoin savings intact. This allows you to use Bitcoin while still accumulating. Paying for everyday goods and services in bitcoin is still hardly possible outside of some experimental areas, but if the signal is not there, who will accept it? Try asking if they accept Bitcoin every time you pay at a local shop, even when you know they don’t. It’s the repeated signalling that will eventually get people curious.

Check out which places in your area are already accepting bitcoin on btcmap.org

Thanks to layer-2 solutions like the Lightning Network, spending bitcoin has become as easy as a regular payment with your phone. Just open your Lightning wallet (like Strike, Wallet Of Satoshi or Phoenix) and scan a QR-code. It’s nearly instant, because you don’t have to wait for your payment to be confirmed on the blockchain. You can experience this at home by feeding cats over the internet or go to a local Bitcoin-meetup and pay for food and drinks using Lightning.

It’s also helpful to start thinking in sats, not fiat. Instead of focusing on Bitcoin’s price in dollars or euros, start thinking about how many sats you own. A small amount of sats today could hold significant value in the future, much like how one cent used to buy a lot more in the past. By thinking in Bitcoin, you will notice deflation taking place, meaning the prices of most things are trending down in Bitcoin terms.

For many people, Bitcoin is a long-term savings tool, not a quick speculative investment. Avoid trading – trying to buy low and sell high – it’s a risky game that most people lose. Don’t try to time the market; instead, focus on consistent accumulation, securing your own Bitcoin, and practicing low time preference – meaning you prioritize future gains and long-term stability over instant gratification (this counts for many things in live, like health and fitness). Every time you buy bitcoin, don’t think about it as consumption, but as swapping soft money for hard money.

Lastly, there’s already people living fully on a Bitcoin standard, meaning they earn in Bitcoin, spend in Bitcoin and save in Bitcoin. All over the world experiments are taking place where local Bitcoin circular economies are spontaneously emerging…

Check out Bitcoin Jungle, Motiv and Bitcoin Ekasi.

Key Takeaways

- Use a reputable exchange to buy Bitcoin, and move it to a wallet you control (self-custody).

- Dollar-Cost Averaging (DCA) is a simple strategy for consistent accumulation without trying to time the market.

- Hot wallets are convenient for small, daily use, while cold wallets (hardware wallets) are essential for storing larger amounts securely.

- Practice “spend and replace” to use Bitcoin for daily purchases while maintaining your long-term savings.

Thank you

If you found value in this guide, feel free to support my work via the pop-up on this page.

Part 4: Quick Reference

Key Takeaways

- Bitcoin is a unique, decentralized, censorship-resistant, peer-to-peer digital money that cannot be stopped.

- There will only ever be 21 million bitcoins, making it a superior savings technology compared to inflationary fiat money.

- Holding your own private keys (self-custody) is a core principle, giving you full control and responsibility over your wealth.

- Bitcoin has many of the properties of gold, but improved for the digital age.

- Bitcoin is the only digital asset that is truly decentralized and can function as neutral, ethical money.

- The Lightning Network is an innovative second layer that allows for fast and cheap payments, making Bitcoin a viable payment system for daily use.

Glossary: Simple Definitions

- Satoshi Nakamoto: The anonymous creator of Bitcoin.

- Blockchain: The public, unchangeable ledger where all Bitcoin transactions are recorded.

- Node: A computer that runs the Bitcoin software and keeps a copy of the blockchain to verify all transactions.

- Miner: A participant who uses computing power to solve complex puzzles, secure the network, and add new blocks of transactions to the blockchain in exchange for a bitcoin reward.

- Proof-of-Work: The mechanism to proof that you did the work (spent the energy) and earned the right to add transactions to the ledger.

- Private key: A secret code that proves your ownership of bitcoin on the network and forms the basis of your public keys and addresses .

- Public key: A public code that is derived from the private key. This key is used to generate all your addresses on the blockchain and ties them together in your wallet.

- Address: Your public Bitcoin “account number” for receiving funds. Unlimited amounts of unique addresses can be created from your public key.

- Wallets: Tools (software or hardware) used to manage your Bitcoin keys securely.

- Hot wallet: A software wallet connected to the internet, convenient for small, daily transactions but more vulnerable to security risks.

- Cold wallet: A physical device that keeps your private keys offline, offering maximum security for large amounts of Bitcoin.

- Seed phrase: A list of 12 or 24 words used as a human-readable backup to recover your private keys and your Bitcoin.

- Lightning Network: A faster, cheaper second layer built on top of the Bitcoin network for instant small payments.

- DCA (Dollar-Cost Averaging): The strategy of regularly buying a fixed amount of Bitcoin to smooth out market volatility over time.

- Halving: A pre-programmed event that occurs approximately every four years, which cuts the reward miners receive for adding a new block by half.

- Sats (Satoshis): The smallest unit of Bitcoin. There are 100 million sats in one bitcoin.

- Custody: Who holds the keys to your Bitcoin. Self-custody means you hold them yourself.

- Fiat Money: Government-issued currency (like dollars or euros) not backed by a physical commodity.

- KYC (Know Your Customer): A process where exchanges and financial institutions verify the identity of their users.

- Low time preference: The mindset of prioritizing future gains and long-term stability over instant gratification.

- UTXO: Unspent Transaction Output. A piece of bitcoin, like a coin or note in your real world wallet. They resemble the bitcoin on the network that can be spent.

- Multisig: A type of wallet that requires multiple private keys to sign a transaction, adding an extra layer of security.